Coronavirus has disrupted our lives. In the coming time, we’re going to see a complete shift in the world’s paradigm, be it economical, social, or environmental.

From being locked in our houses, to limiting our demands and changing our habits, the impact of the virus seems to penetrate us on a very molecular level.

Businesses have either shut down or shifted online, millions are unemployed, around 100 countries are in lockdown, medical facilities are overwhelmed, and people are living in isolation. The ramifications are endless, and each day something new comes to light.

One thing is certain: when all is said and done, the world will never be the same again.

“In the worst case scenario, global economy could contract by 0.9% in 2020” -DESA

Faced by the current scenario, every sector will see large scale changes, unprecedented by what we’ve seen in recent times. If we talk about the eCommerce industry, in particular, the exact degree and nature of change is ambiguous.

This article will cover:

- Coronavirus Impact on Consumer Shopping Behaviour

- Latest eCommerce Industry Trends & What they Mean

- Overall Takeaways from the Above Data

- Supply Chain Issues and Inventory Shortages

- What do Experts Say about the Future?

- Ways to Protect your Business During Covid-19

Coronavirus Impact on Consumer Shopping Behaviour

If you’re following the news closely, you might have come across the term ‘panic buying‘ by now. When cases in Italy surged dramatically, the country was put under lockdown. This sent a ripple of panic across the globe.

People realized that this could well enough be the future of their own country. When WHO declared Coronavirus a pandemic, everyone started stockpiling essentials.

There were news reports of department stores running out of toilet paper, sanitizers, masks and essential food items like bread. Retailers and eCommerce stores alike reported a hike in demand during the early days (Jan to Feb 2020) of the pandemic.

With more and more people avoiding public market places and turning to online shopping, you would expect the eCommerce industry to triple its sales and revenue. But sadly, it’s complicated.

With cases topping 1 million, and 100+ countries under lockdown, the demand for non-essential commodities has seen a sharp decline. Pay cuts and job losses are forcing people to limit discretionary shopping. They are instead spending more than usual on essential items, fearing that the stocks might run out.

This extra spending on essential items has put pressure on eCommerce, and e-tailers are having a hard time meeting consumer demand due to product shortages, low availability of delivery personnel, supply chain issues, and shipping problems.

Coronavirus Impact: Latest eCommerce Industry Trends & What they Mean

Coronavirus cases are still expected to soar, and it’s hard to say when we will see a decline.

Consumer behavior is still changing and countries are still adapting to the new paradigm, which is why it is hard to paint a clear picture of the exact impact as of now.

In this section, we’re going to see the trends eCommerce has seen in the past few months, and what it could mean:

1. Preliminary Data by Quantum Metric

Quantum metric released data reflecting retail industry trends for the period of Jan-Feb 2020.

- eCommerce businesses associated with brick and mortar retailers saw an average revenue weekly growth rate increase of 52%, followed by an 8.8% rise in conversion rates. This was based on 5 billion U.S. retailer website visits.

- However, the traffic online declined in mid-March.

- In February, there was a 108% increase in online orders, year-over-year. But average order value (AOV) declined by 31%.

The above data suggests that, the sudden uptick in online shopping was mainly because of two reasons:

- Brick and mortar stores were shutting down. With social distancing norms in place, people wanted to reduce human contact as much as possible.

- Industries were shutting down. Faced with the possibility of a complete lockdown, shoppers started buying on impulse, purchasing more of the same essential & cheaper items (hence the low AOV).

2. Data Compiled by Common Thread Collective for March 2020

The following is some insightful data compiled by Commonthread from various sources:

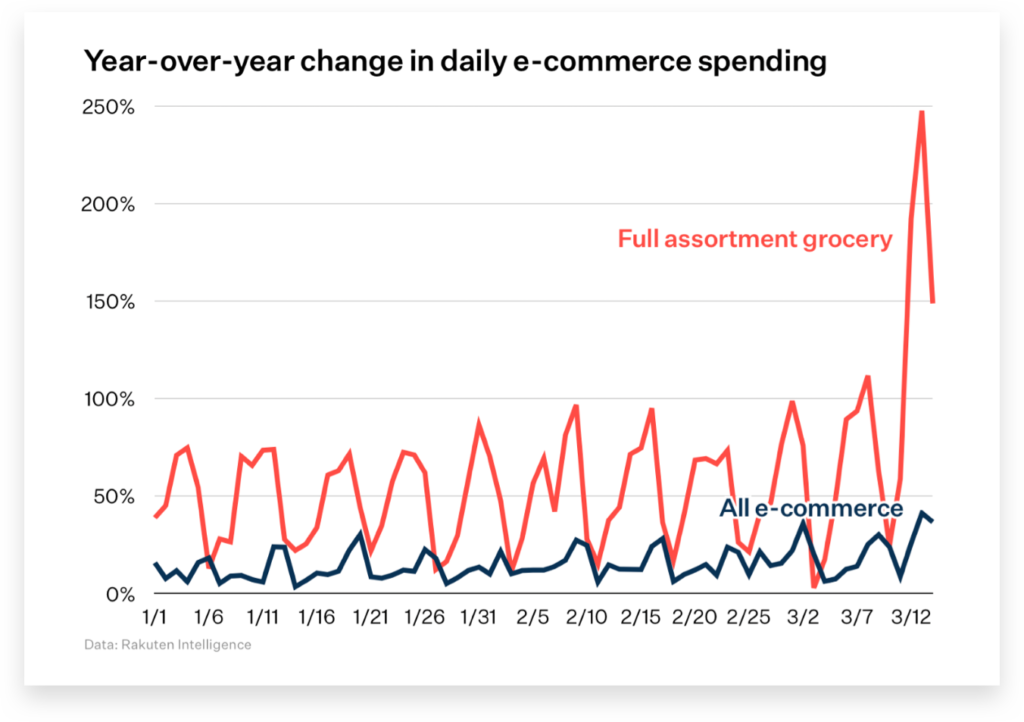

- Rakun intelligence found a 36% year on year increase in eCommerce spending in the US.

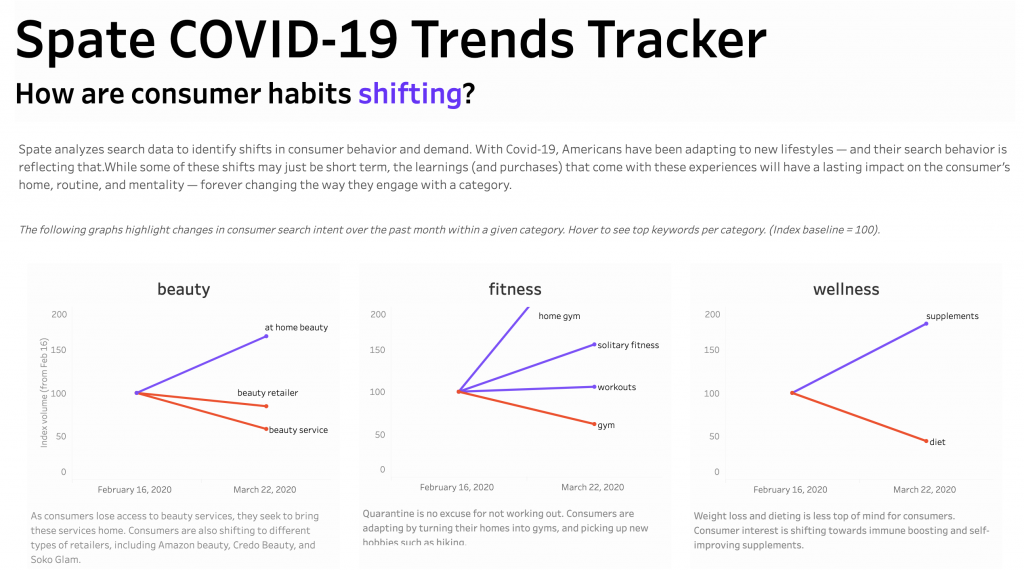

The above image shows that overall eCommerce spending has increased in the month of March. Most of this increase can be attributed to higher spending on groceries online.

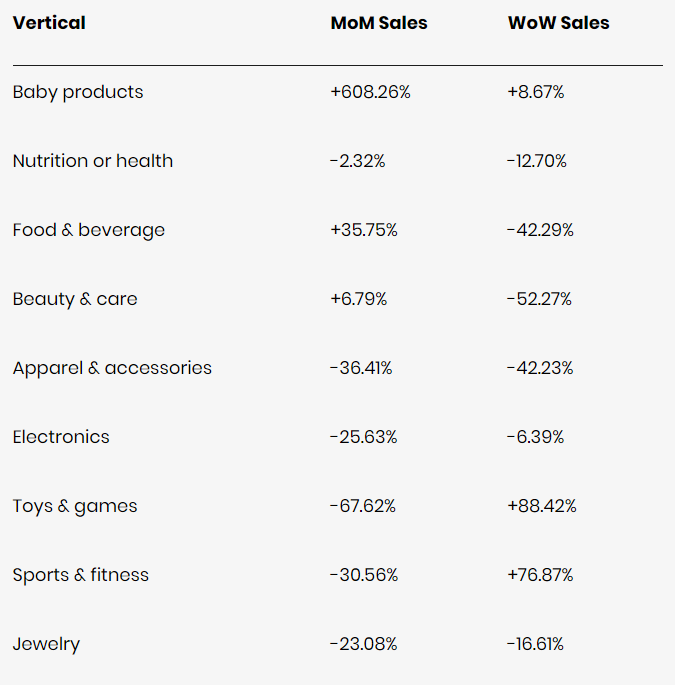

- Data from ShipBob, monitoring 3000+ US merchants shows the following data across different segments:

The above data shows disparity among verticals. While the month-on-month sales in the Beauty sector have seen an increase in sales, Apparel and accessories have experienced a decline of 36.41%

This proves that while an increase in online food and beverage sales is obvious. When it comes to other sectors, consumer behavior is still unpredictable. Some sectors are seeing a sharp decline, but others seeing a rise in sales.

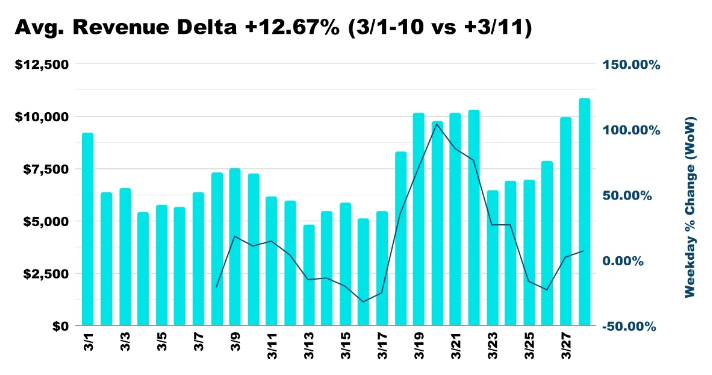

- The following graph talks about the over revenue increase in eCommerce in the US.

In this graph, the month of March has been divided into two parts- from 1st to 10th, before the country went into quarantine, and from 11th till 27th, after country was quarantined.

It shows an average increase of 12.67 in revenue across the two periods.

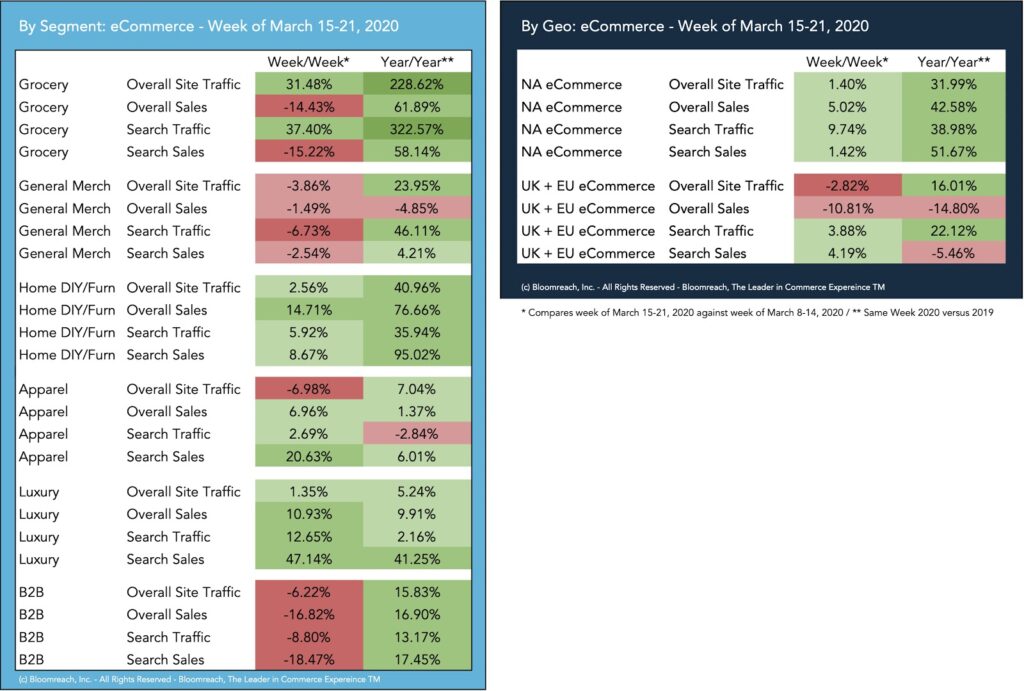

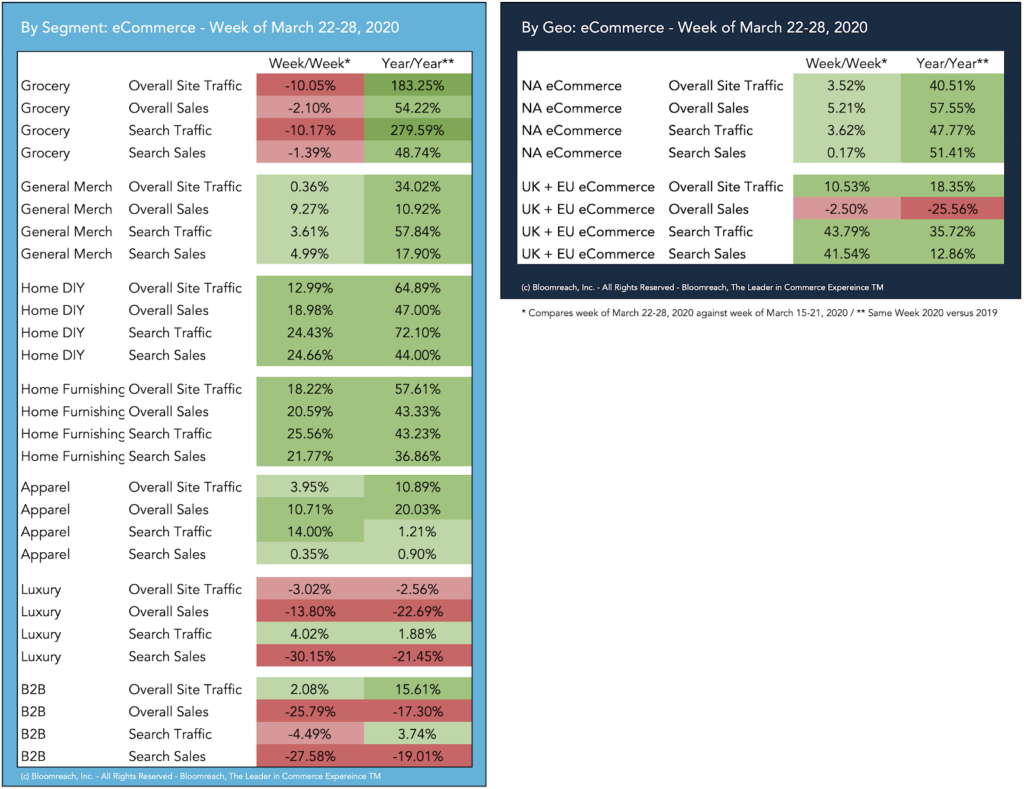

3. Data by Bloomreach

Bloomreach has released data on a weekly basis for the month of March, showcasing eCommerce trends across US, EU, and the UK.

- eCommerce sales and traffic for the week of March 15-21

- eCommerce sales and traffic for the week of March 22-28

Takeaways from the above data:

- Grocery sales declined in the last week of March, but the year-on-year sale is high. This means that consumers are spending more than last year, but there is a weekly decline due to supply and delivery personnel shortages.

- The home furnishing and DIY segments have seen higher traffic and sales because people now have to manage home projects on their own. Moreover, quarantined at home, they finally have time to spare for such projects.

- The luxury sector is struggling because people have limited discretionary spending. The search traffic for such items remains high because people are looking to get special deals by specific brands that would want to clear out their stock.

- The B2B sector has also seen a decline in sales and traffic, for two consecutive weeks in March. A lot of businesses are giving work from home to employees or laying them off. Many businesses are trying to cut costs and have lowered their scale of operation for the time being.

Overall Takeaways from the Above Data

- Consumer confidence has declined. Meaning, consumers are skeptical about the future prospects of their financial situation and of the economy as a whole. This reflects in the change in their buying behavior across sectors.

- While search traffic has increased, conversion rates have declined. Lockdowns and pay cuts are prompting people to spend less, even if they’re searching for things online. Also there are shortages, so eCommerce merchants aren’t able to meet the demands.

- The trend in eCommerce sales varies across different sectors and regions. Most of the data online is conflicted, showing irregular and unpredictable industry trends.

eCommerce businesses selling non-essential items are seeing a drop of 40%-60% in their sales.

Business2Community

Supply Chain Issues and Inventory Shortages

In late January, China shut down the city of Wuhan area and the Hubei province. Millions were under lockdown, and a lot of manufacturing industries were affected.

China makes up a third of manufacturing globally, and is the world’s largest exporter of goods.

This was a cause of great concern for many countries across the globe, as most of them rely on China for goods and parts used in manufacturing products.

This obviously must have put a significant strain on the global supply chain. While China is now on the path of recovery and is likely to go back to normalcy soon, other countries are still densely infected by the virus and remain in lockdown.

Though governments are making efforts to keep the supply flow seamless, it is proving hard to do so in the midst of a pandemic. Cargo ships, planes, trains, etc have become non-functional in a lot of countries in order to curb the spread.

In many countries, local transport has also been stopped. Meaning, truck drivers and delivery agents can’t be on the roads to make deliveries.

Recently, Amazon’s supply chain came under a lot of stress because of high demand for staples. As a result, Amazon decided to stop the shipment of non-essential products till April 5, and instead focus only on baby products, food, health supplies, etc.

Brick-and-mortar retailers, as well as eCommerce stores, are facing a lot of inventory shortage issues. Stock deliveries are delayed, many supply orders are being canceled, and almost every shop (online or offline) is facing delivery backlogs.

What do Experts Say about the Future?

Experts and industry analysts predict that in the short term, eCommerce merchants could expect a dip in sales.

“The question becomes how employment, income and the wealth effect play into all of this: If you lose 30% of your 401K, you might not want to buy that extra sweater or other non-essentials,”

Stuart Rose, partner, Mirus Capital Advisor

Consumers are still adjusting, and if the situation worsens it could only mean bad things for the industry.

However, data shows us that the overall impact will most likely be softened by variations in sales and revenue across different eCommerce sectors.

Merchants selling essential items will benefit largely, despite the shipping and delivery impediments. Whereas merchants dealing in fashion or luxury items will find it hard to keep themselves above the water during this time.

In the long run though, experts predict that eCommerce will benefit substantially. Change in lifestyle will prompt consumers to shift their shopping online. Many of them will embrace the concept and find it hard to go back to their regular shopping habits once life returns to normal.

In fact, we already have some data to prove the above prediction:

“50% of Chinese and 31% of Italian consumers say they’re using ecommerce ‘more frequently’.”

“Other countries such as Vietnam, India and Russia have also seen their populations turning to ecommerce more often to shop – with increase of use measured at 57%, 55% and 27% respectively.”

The above statements have been quoted from econsultancy, from a study conducted by IPSO Mori.

Around 75% Americans said that they would shop online during this time

Business2community

Ways to Protect your Business During Covid-19

1. Modify your Social Media Strategy for the Time Being

Everyone’s spending a lot more time than usual on social media. Most businesses have changed their social media strategy to make it more relevant to the current scenario. Figure out how you can connect with people online and help them during this time of stress.

There are innumerable things you can post- workout regimes, things to do at home, ways to stay productive, easy things to cook at home, suggestions on learning something new, podcasts related to your industry, etc.

For example, if you’re a fashion brand experiencing a dip in sales, you could collaborate with fashion bloggers for podcasts or putting together looks using your brand’s clothing.

Just find something that is relevant to your business and audiences, and don’t shy away from experimenting a little.

Pro tip: make sure that your social media content is focused on connecting with the audience and not making sales.

2. Nurture your Customer Relationships Even More

We’ve already read that consumer confidence is at an all-time low. Transparency is the key, so make sure you communicate with your clientele and let them know the state of your operations. Also, let them know the steps you’re taking to ensure safe delivery.

For example, a lot of eCommerce businesses are employing a ‘no contact’ delivery method, wherein the delivery person leaves your package on the door so that you can collect it when he/she is gone.

Nurture your customers and their trust. Reassure that your business isn’t going anywhere and respond promptly to their requests.

3. Expand your Supply Chain

Supply shortages are common nowadays. Diversify in terms of manufacturing and fulfillment locations if possible.

One good way to go about this is to connect with local vendors who will now see a decline in footfall. They will also be looking to make more sales, so a collaboration with them could be profitable for both sides.

4. Don’t Sacrifice on Marketing!

Marketing is the ship that is going to keep your business afloat during this time. App downloads have surged worldwide. The data we’ve shared above is a testament to the fact that, even though consumers are aware they won’t be making purchases anytime soon, they’re still looking for things online.

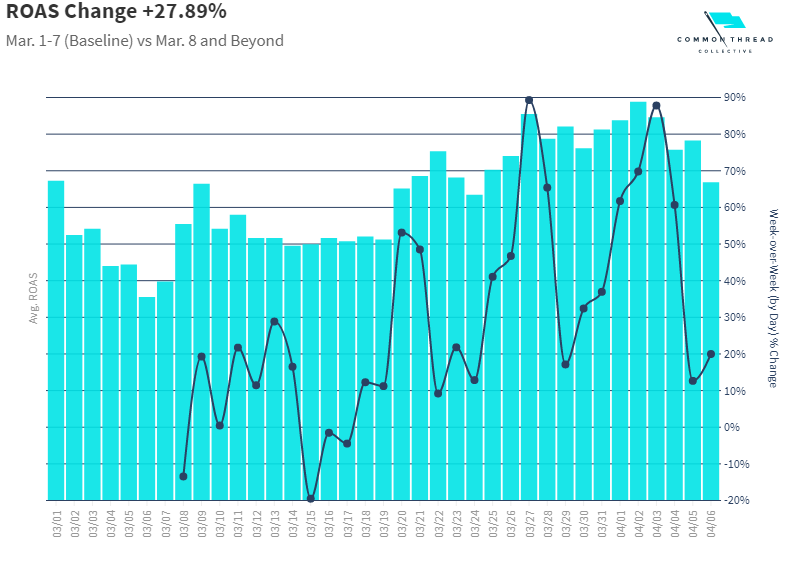

Website traffic is definitely not going anywhere. Moreover, revenue on ad spend (ROAS) has seen an industry-wide increase since March 7, according to Common Thread Collective:

This means that it’s advisable to keep running online ads. Viewership of online platforms like Tik Tok, Instagram, and Youtube has increased. This is a great opportunity to invest in display ads and get customers interested in upcoming products.

Now is the time to market your business rigorously, more than ever.

5. Find out Smart Ways of Cutting Costs

Pay cuts taken by senior and mid-level management are quite common these days. While it is the most obvious way to cut costs, it is not the only one. You can find other ways, however little, to cut down on those extra bucks that aren’t bringing in any revenue at the moment.

For example, If you have any plugin or extension, that requires recurring payments and isn’t really needed right now, it would prudent to remove/disable it for the time being.

eCommerce companies invest in hosting services. Merchants can ask their providers what steps should be taken to cut costs from their end. For example at Webscoot, we’ve scaled down our servers running on AWS and set them according to the current traffic trend that our client websites are seeing.

6. Prepare for the Future

eCommerce industry is expected to grow post Coronavirus, but the trends will change. Keep on top of the trends that eCommerce businesses are showcasing right now, and try to pick on the things that are here to stay.

For example, a lot of businesses are considering drone delivery for the future. Even when Coronavirus is gone and people are back on the streets, drones seem to be a very economical way to deliver products, especially locally.

The DIY and home furnishing industry are seeing an increase in consumer interest, and maybe that interest is here to stay. People still might want to continue assembling or fixing their furniture on their own. So instead of just selling a fully assembled cupboard, an online furniture store could also start offering separate parts.

Lastly

We’ll know more about the Coronavirus impact in the coming day, as more developments unfold. Till then, all we can do is try our best to adapt to the situation and make the best out of it.

So sit tight and stay safe. If you have any queries or comments, do mention in the comments below!

Interesting read: Dropshipping Business Plan: How to Build A Successful Online Business

Divya loves writing and is passionate about marketing. When not trying to hone her skills, you’ll find her either reading or binging on TV shows.

0 Comments